Back This Summer Housing Market Is Hot

July 16, 2021

Home>> Hot Summer Housing Market

In real estate, it’s normal to see ebbs and flows in the market. Typically, the summer months are slower-paced than the traditionally busy spring. But this isn’t a typical summer. As the economy rebounds and life is returning to normal, the real estate market is expected to have an unusually strong summer season.

Here’s how this summer is stacking up against the norm and what it means for you.

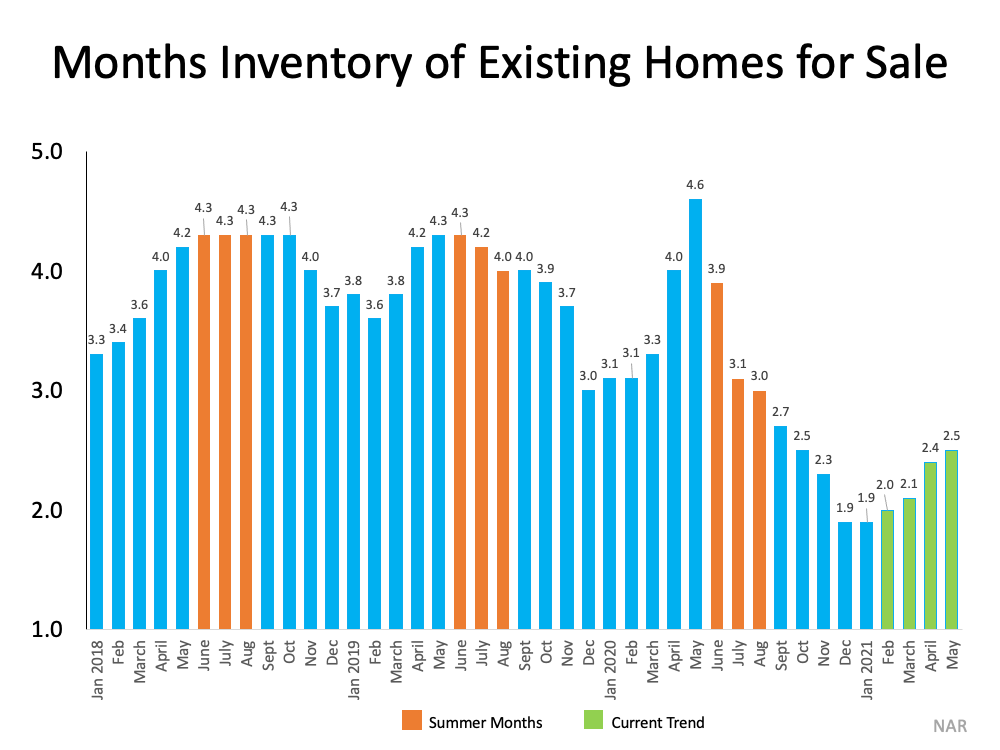

Inventory is increasing.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), inventory levels have been rising since February of this year. Looking at the graph below, there’s a clear upward trend, as shown in the green bars. Currently, there’s roughly a 2.5 months’ supply of homes for sale. And while inventory is trending up as more houses are coming to the market, it’s still much lower than several of the previous summers, as the orange bars indicate.

If you’re looking to buy, some relief is on the way in the form of more homes coming to the market. Just remember, we still have less inventory than the norm, so be patient in your search.

Interest rates are back down again. After flirting with an upward trend early in the year, interest rates have come back down. Lower rates contribute to continuing affordability even as prices rise. We have recently seen a five-month low.

If you’re thinking of selling, now is the time. Work with your agent to list your house before it has more competition on the market.

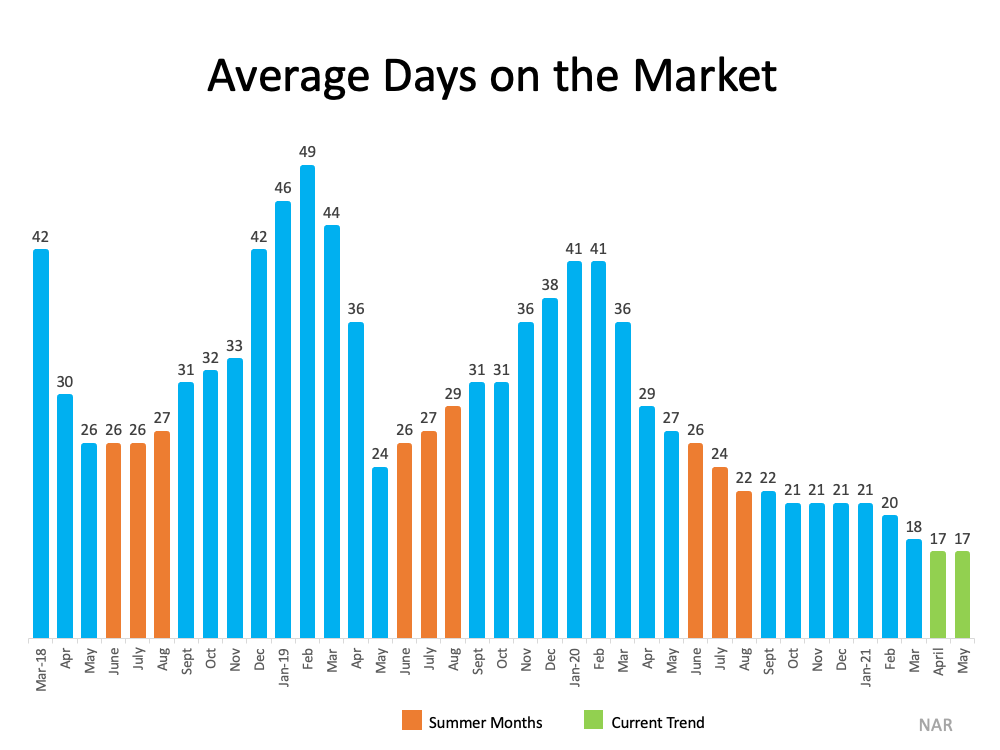

Time on the market is still shorter than normal.

Unlike the typical summer trend, time on the market is moving at the fastest speed we’ve seen since NAR started collecting this survey-based information in 2011. The most recent Realtors Confidence Index shows that the average home is on the market for just 17 days, as shown in green in the graph below. This means houses are selling at a much faster pace than a typical summer, which the orange bars represent.If you’re looking to buy, this means you need to be prepared to move fast. Brace for a quick pace and rely on your agent to stay in the know on the available homes in your area.

If you’re thinking of selling, data shows your house will likely sell quickly. If you’re worried about where you’ll go once your house sells, consider a newly built home as a good way to move up.

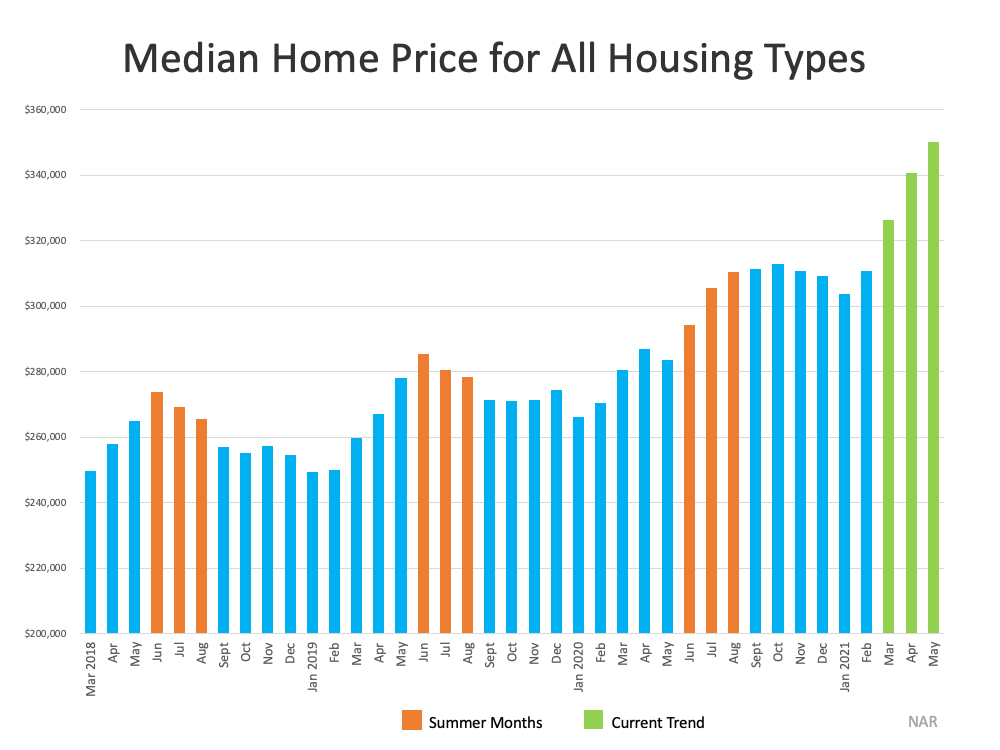

Price appreciation is still rising.

The last big factor making this an unusually strong market this summer is home price appreciation. According to the State House Price Index from the Federal Housing Finance Agency (FHFA), we’re currently experiencing double-digit house price appreciation and have an average of 12.6% appreciation across the country. The graph below uses data from NAR to show a more granular view of how prices have changed month-to-month over the past few years. The green bars show the current price appreciation we’re experiencing today. Our current levels are well above what we’ve seen in recent summers, shown by the orange bars.

If you’re looking to buy, competition and bidding wars are driving prices up. Getting pre-approved can show the seller you’re serious and help you know what you can afford. Once you do, work with your agent to make a strong offer that stands out.

If you are looking to refinance, rates have dipped yet again. Refinancing can offer several benefits, whether you want to lower your payment, consolidate debt, take cash-out, and more.

If you’re thinking of selling, seize this opportunity to use your additional equity from this price appreciation to power your next move.

Bottom Line

This isn’t a typical summer. Whether you’re buying or selling, let’s connect to talk about how you can capitalize on today’s market conditions to sell your house or find your dream home.

Use our Interactive Home Sale Proceeds Calculator:

Use Our Interactive Refinance Calculator Below:

Use Our Interactive Home Payment Calculator

Get in touch with YOUR loan officer today. To find a loan officer click HERE